In our daily life, we may use foreign currency for savings, travel, and investment. Therefore, a freely convertible foreign currency account has become a necessity for many people. This article will introduce the functions and account opening process of foreign currency accounts, and also explain the differences between general foreign currency accounts and "foreign exchange margin accounts" used for foreign exchange trading.

The main functions of foreign currency accounts

1 / Exchange foreign currency online

It is very convenient to exchange currency using a foreign currency account. Most of the time, you only need to convert your local currency into foreign currency in the online bank, and then make an appointment to withdraw it at the bank counter. The exchange rate and handling fee are lower than taking cash to the counter to exchange, and you can save the price difference between the cash exchange rate and the spot exchange rate.

2 / Long-term holding of foreign currency

Foreign currency accounts are suitable for people who want to hold foreign currency for a long time as a savings account. The interest rate on foreign currency time deposits offered by banks is often higher than that of the local currency, so holding foreign currency for a long time is a way to preserve capital.

In addition, when the domestic currency exchange rate is not good and the economy is in a downturn, we need to buy safe-haven currencies, which is also the reason that drives us to hold foreign currencies for a long time.

3 / Buy low and sell high to earn the price difference

When a foreign currency exchange rate reaches a recent low, all the local currencies held are converted into foreign currencies. When the foreign currency appreciates in the next few months, all the foreign currencies are converted back to local currencies, and a huge profit can be made from the price difference. This is a type of investment. Foreign currency accounts can be used for long-term buying low and selling high, while short-term foreign exchange speculation is recommended to use a foreign exchange margin account with a lower exchange rate difference.

Bank foreign currency account opening process

1. Select a bank

The most important thing is to choose a bank with good reputation to facilitate currency exchange later. If you do not have a local currency account, you need to open one in advance.

2. Bring the required documents, seal and local currency passbook

When opening an account for the first time, you need to deposit a local currency account with a specified amount, such as RMB: USD = 7:1. The bank may require at least USD 100 to open an account, so the local currency account must have at least RMB 700.

If you need to open online banking, you can apply for it with a bank specialist.

3. The specialist will then transfer the deposit in the account to the foreign currency account

One account can be used to deposit multiple currencies, and the conversion is mainly based on one's own needs. It should be noted that many banks' foreign currency accounts only provide exchange and deposit and withdrawal services for major currencies, and are not suitable for unpopular currencies.

By the way, if you deposit foreign currency directly into a foreign currency account, you may be charged a handling fee. It is recommended that you check with the bank in advance.

The difference between a bank foreign currency account and a foreign exchange margin account

As mentioned earlier, if you want to make short-term foreign exchange trading investments, it would be more appropriate to open a foreign exchange margin account than a bank foreign currency account.

Foreign exchange margin refers to a contract signed between a client and a platform, followed by the opening of a third-party trust investment account, where a sum of money is deposited as collateral (i.e., foreign exchange margin). The platform then sets the operating limit, which is usually magnified by more than a hundred times (i.e., the leverage effect). After that, investors can freely buy and sell equivalent spot foreign exchange within the platform's limit, and the resulting gains and losses are calculated in the third-party trust account.

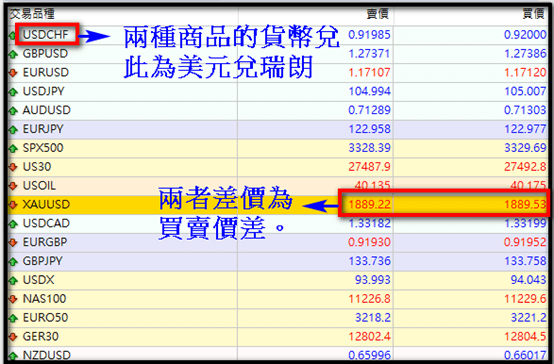

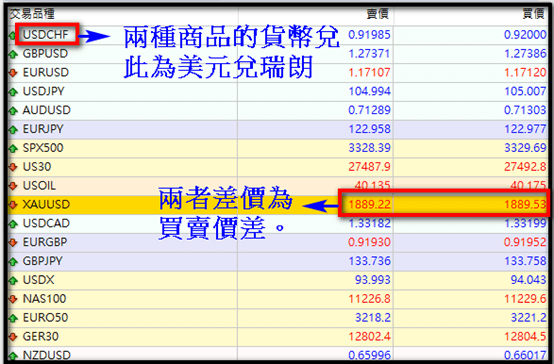

In the process of forex margin trading, the platform will charge a fixed fee for buying and selling forex to make a profit, and of course it will make a profit on the spread. For example, the RMB to USD exchange rate in the market is 7:1. If you buy USD through the platform with margin trading, the exchange rate may be higher, such as 7.01:1. In addition, there are some so-called overnight interest fees for holding positions, which will be displayed on the platform.

Comparison between foreign currency account and forex trading account

| |

Foreign Currency Account |

Forex Margin Trading |

| Long and short restrictions |

Only buy and hold |

Long or short |

| Settlement Date |

According to the deposit contract |

none |

| Handling Fees |

According to bank regulations |

According to the industry's customization |

| Leverage Ratio |

1:1 |

1:100 or more |

| Funding threshold |

Higher |

Low |

Generally speaking, this is also the difference between foreign exchange trading that the public is exposed to and the so-called "foreign exchange speculation".

In simple terms, the foreign exchange transactions that the general public is exposed to are relatively more life-oriented, mainly focusing on bank deposits, actual needs including cash exchange for travel, and living expenses for children's overseas studies, etc. Although foreign exchange speculation is the appreciation or depreciation of different foreign currencies, the basic concept is the same, but the actual operation is quite different.

There are five main differences between buying and selling foreign currencies and speculating in foreign exchange:

Foreign exchange allows two-way trading

That is, you can make money not only when the foreign currency appreciates, but if you can see the depreciation of a foreign currency, you can make money even if you are bearish. The trading rules in foreign exchange allow "sell first and buy later", and you can sell the relevant foreign currency first without holding it. Traditional banks buy and sell foreign currencies, and you must wait for the foreign currency to depreciate before buying, and then wait for the foreign currency to appreciate before you can make a profit. It may take a long time to wait and hold, which means a long buying and selling cycle.

Lower cost

The cost of a foreign exchange transaction mainly comes from the bid-ask spread. If you refer to the general quotes of banks, the transaction costs involved in the spread will be more than dozens of times higher than the so-called foreign exchange speculation, or even 100 to 200 times. Of course, it also depends on what kind of customer the client is. The bid-ask spreads provided by foreign exchange companies or brokers are very favorable in response to the frequent transactions of customers.

24-hour trading time

The foreign exchange market operates 24 hours a day, even when some countries have holidays, there are transactions. Therefore, basically all brokers that provide foreign exchange transactions also provide 24-hour transactions. However, 24-hour transactions are not completely popular in banks at present. The key issue is that the most volatile time for foreign exchange prices is often from the evening to the early morning of Asian time, that is, the so-called US trading time. In disguise, there is a big difference in grasping the entry price of the market.

No spot delivery involved

Foreign exchange speculation is different from bank transactions. There is no need to deposit or withdraw foreign exchange cash, etc. Therefore, if you really need to use foreign currency cash in your daily life, you still need to go to the bank to handle it.

More complete trading tools

Generally, foreign exchange brokers will be equipped with a fairly comprehensive online trading platform for customers to use, so that customers can enter and exit the foreign exchange market at any time, set entry and exit prices, and establish a trading strategy. These platforms will also come with comprehensive charting functions to help customers study the market.

Benefits of using a Forex Margin Account over other investment options

High leverage

As long as you deposit a certain amount of margin, you can get more than a hundred times the available funds. Because the fluctuation range of foreign exchange is relatively small, you can use small investments through margin trading to seize profitable opportunities in the foreign exchange market and magnify profits and income, which has the inherent effect of "making a small investment for a big gain" and "magnifying returns".

Two-way trading

One of the biggest advantages of margin trading is that it can be operated in both directions. This undoubtedly provides more flexible operating strategies compared to the stock market where most transactions can only be conducted in one direction.

High liquidity and long transaction times

The foreign exchange market has a huge trading volume, some major currencies have strong carrying capacity, and it also covers different time zones around the world, making trading hours almost uninterrupted. Compared with the stock market, trading hours are not only longer, but also have more profit opportunities.

Examples of symbols and spreads:

Common questions and precautions

The advantage of margin trading allows investors to make profits regardless of whether the market is rising or falling, but how to make the right entry time and stable operation methods are even more important. The accumulation of experience will be the only way to success, and any investment has certain risks. Investors still need to measure the amount of investment based on their own financial capabilities.

Due to the leverage effect, profits can be magnified in margin trading, but the amount of loss is also magnified, which is also the main risk of margin trading.

In the foreign exchange market, because it involves the currencies of many countries, the economic development, policy implementation, debt status, etc. of each country will affect the trend of the country's currency. Investors' information collection and professional interpretation capabilities are relatively high, so it is also a threshold for beginners.