The foreign exchange market is the largest market in the world. Due to the time difference between countries, the foreign exchange market operates almost 24 hours a day. This means that there are trading opportunities in the foreign exchange market all the time, and many traders have also devoted themselves to it. However, for newcomers, the dazzling array of currency combinations in the market is dizzying. Among so many combinations, which ones are the more stable trading targets ? This article will take you to find out.

In the current financial market, the United States has a mature financial system, a leading central bank system and an economy, which makes the U.S. dollar still the reserve currency of countries around the world. Therefore, in the foreign exchange market, currency pairs against the U.S. dollar are generally more stable.

The investment market generally uses the US dollar index (DXY) as a reference to determine the trend of the US dollar. The index includes 6 component currencies, namely the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

| currency | Code | Proportion (%) |

| EUR | EUR | 57.6% |

| Date | JPY | 13.6% |

| GBP | GBP | 11.9% |

| Canadian Dollar | CAD | 9.1% |

| Swiss Franc | SEK | 4.2% |

| Swiss Franc | CHF | 3.6% |

Table 1: Composition of the US Dollar Index

In addition, more developed economies generally have more investors operating in them, such as Australia, New Zealand and other countries, which are also favored by the market. In foreign exchange trading practice, the main currency combinations we often pay attention to are the following 7 currency pairs against the US dollar, also known as "straight trading":

Euro/US Dollar (EUR/USD)

GBP/USD

Australian Dollar to U.S. Dollar (AUD/USD)

New Zealand Dollar to US Dollar (NZD/USD)

USD/JPY

Swiss Franc to US Dollar (USD/CHF)

USD/JPY

The above are currency pairs against the US dollar. If it is not a combination against the US dollar, such as the Australian dollar against the Japanese yen (AUD/JPY), such a combination is called a "cross pair".

We have listed 7 major currency pairs above . Since the US dollar is the most actively traded currency in the global foreign exchange market, the trading volume is the largest, which also makes the spreads of these currency pairs relatively narrow and small. The lower transaction costs also mean that investors can make profits more easily.

The risk of trading these major currency pairs is relatively low because these countries are common major economies, and there are many relevant economic news or published economic data, and the fundamentals are relatively transparent. In addition, as mentioned above, these currency pairs have a large trading volume, and the foreign exchange market operates 24 hours a day, forming a huge liquidity, which in turn makes the foreign exchange market unlike the stock market, where there are major players who can manipulate prices. Therefore, most of these major currency pairs will not experience dramatic fluctuations, and the trend is easier to continue.

As a result, the advantages of the foreign exchange market have attracted a large number of investors to operate, and there are a large number of transactions every day, which continue to support the benefits of the above spreads and volatility. The risk of trading operations is relatively low, and it is also suitable for novices who have just entered the market.

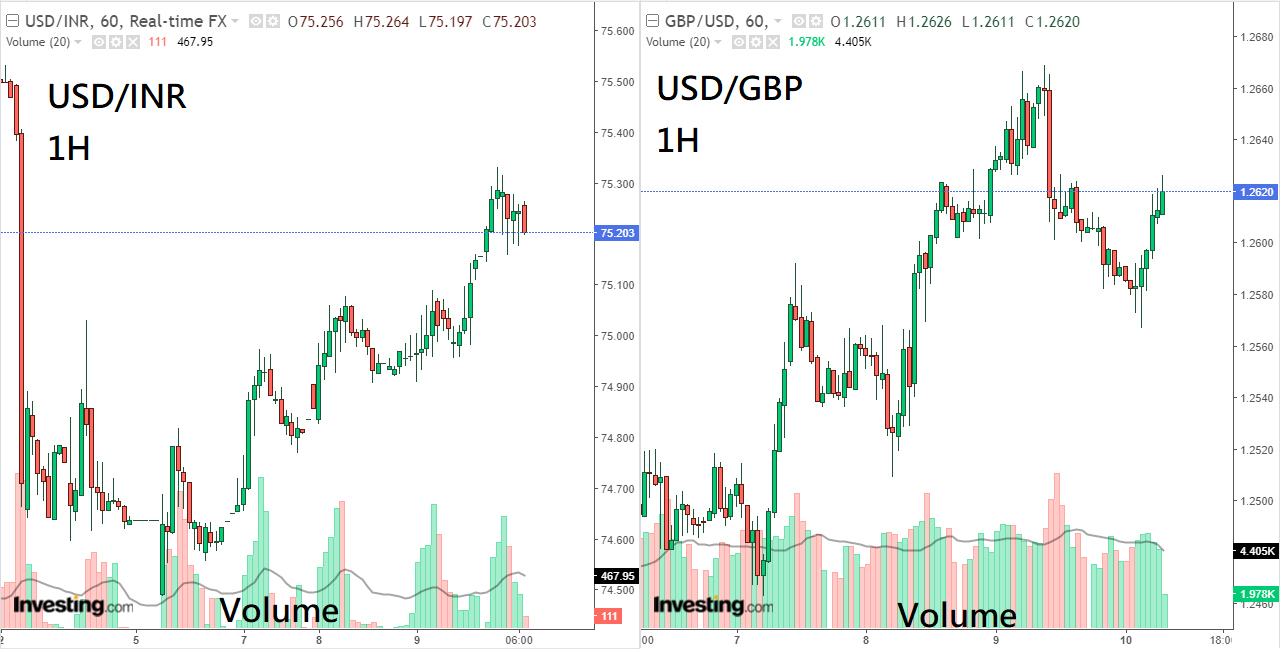

以上方的美元兑印度卢比(USD/INR)与英镑兑美元(GBP/USD)来看,在下方的成交量图形(Volume)中,印度卢比的成交量有着显著的落差,并在图表的开端出现了暴跌的情况。另一边的英镑,成交量较平均,走势也显得相对有规律。

In addition to the above-mentioned currency combinations, investors can also choose to trade other varieties, such as the Australian dollar against the Japanese yen (AUD/JPY) or the euro against the British pound (EUR/GBP) as mentioned above. These non-US dollar currency combinations are called cross pairs.

Compared with major currency pairs, cross trading volume is usually smaller, and smaller trading volume is prone to a larger ups and downs due to the sudden influx of short-term buy or sell orders. In addition, if the fundamentals of some trading targets are clear, such as the recent downward trend of the yen and the recent bullish trend of the euro, it is reasonable to infer that the probability of the euro against the yen (EUR/JPY) rising is higher. If you enter the market directly in this currency pair and analyze it accurately, you will have the opportunity to make more profits, or even have a larger profit margin.

As mentioned earlier, the trend of cross-rates is prone to sharp rises and falls due to lack of liquidity. Although such fluctuations are an advantage for quick profits, they are also a double-edged sword. For example, investors who are accustomed to trend trading may disrupt their previous trading plans due to sudden sharp rises and falls.

On the other hand, the difficulty of doing basic and technical analysis is slightly higher than that of major currency pairs. Taking the news of Brexit as an example, it has a decisive impact on the trend of the euro and the pound, but some situations or certain events may have a lesser impact on the euro and a greater impact on the pound. Such different degrees of impact will directly increase the difficulty of fundamental analysis; and in technical analysis, we must also look at the technical trends of the euro and the pound against the US dollar at the same time, which may affect the trend of the cross market. Even if both may be upward trends against the US dollar, they may be inconsistent in time, leading to the rise and fall of the euro against the pound (EUR/GBP) cross market. This is also the main problem common in short-term operations when trading cross markets.

After introducing the combination of straight and cross trading, I believe everyone should have some understanding of these two different types of trading targets. So when actually investing in trading, what factors can help us quickly grasp a good operating target ?

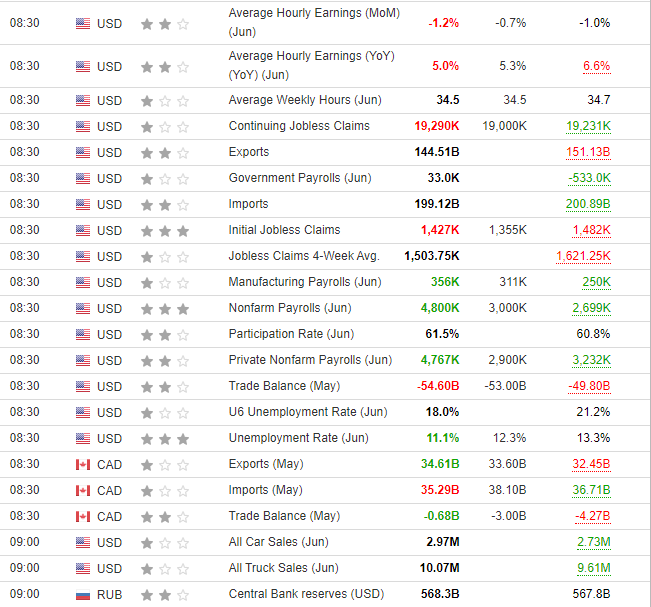

Commodities with ample liquidity and large trading volumes, such as the seven major currency pairs against the US dollar, have relatively stable fluctuations and rarely experience sudden surges or plunges. In addition, it is relatively easy to obtain relevant data and news at the first time, and immediately grasp the market trend. According to the financial calendar below, US economic data is released almost every day, and when these data are released, there are often movements in currency pairs against the US dollar, and the opportunity to enter the market increases at this time.

Therefore, it is recommended that novices who have just started trading and are not so easy to grasp the rhythm of the market can choose these major currency pairs to operate. At the same time, the trends are relatively obvious and lasting. As long as they follow the general trend, the winning rate and returns are generally relatively good.

There are many currency combinations in the market, and the trends are ever-changing. Therefore, in addition to studying fundamentals and data news, investors also need to understand technical and graphic analysis. When investors become proficient in technical analysis, they can formulate their own strategies and find their own way to make profits. Therefore, when you choose what commodity to trade, just pay attention to these currency combinations and whether they are consistent with your technical analysis. It is relatively easy to find the correct buying and selling operation signals in the analysis.

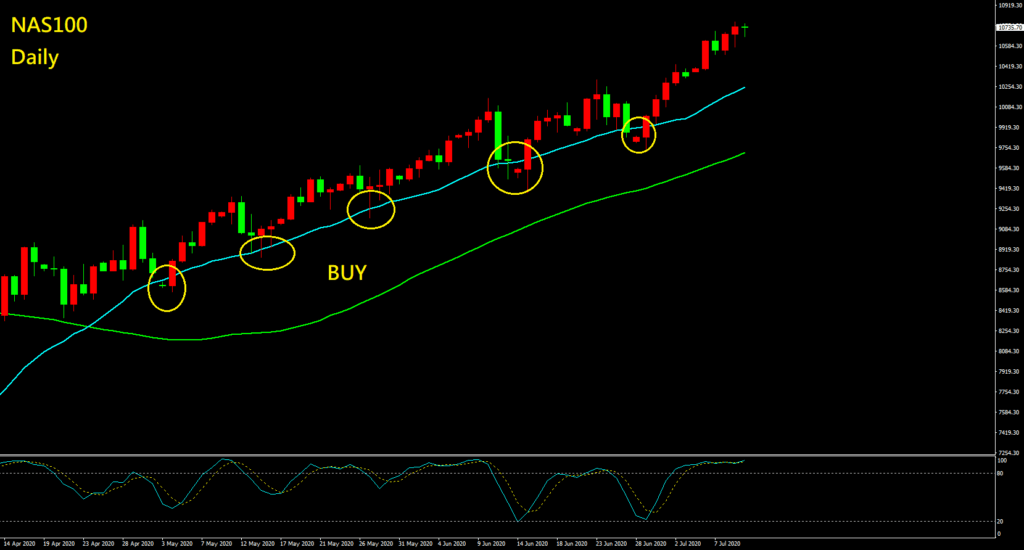

Taking the trend trading of moving averages as an example, as long as the trend touches the moving average support, you can enter the market and go long. Although this trading method is simple, it is still a very effective and potentially profitable approach.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.