Contract for Difference ( CFD ) is a relatively new and increasingly traded financial derivative. As the saying goes, knowing yourself and your enemy is the key to success. Before investing your hard-earned money in a financial product, you must have a thorough understanding of the product. Here is a simple explanation of what CFD is to help you learn about this new and increasingly popular financial product, and avoid paying "tuition fees" in vain because you are not familiar with the operation of the product.

CFD ( Contract for Difference ) is a relatively new and increasingly traded financial derivative instrument. It generally refers to an exchange contract for physical commodities or securities (including foreign exchange, stocks, indices, commodities, cryptocurrencies, etc.) that does not involve the delivery of physical commodities or securities, and is a trading method in which only the difference between the settlement price and the contract price is used for cash settlement.

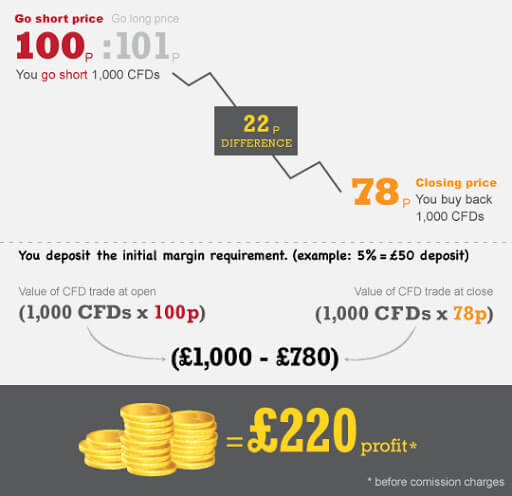

The trading method of CFD is that investors pay a certain amount of margin to the bank or broker according to the agreement , generally 1-5% of the total contract value, to open the contract (open a position), and the rest is provided by the broker or bank with credit support, such as general financing or securities lending operations, to purchase the full contract value in the market. The contract will settle the profit or loss according to the difference between the agreed opening price and the closing price. Please note that under normal circumstances, investors also need to deposit more funds than the required margin to maintain the contract for the position. If the potential loss caused by the fluctuation of the contract value is greater than the specified margin requirement, it will trigger a forced liquidation instruction and the position needs to be settled immediately.

For example, UACTCTK provides 100 times leverage in gold CFDs . Investors only need to pay a margin of 100 yuan to purchase gold CFDs worth 10,000 yuan in the market . If a long position is opened, if the gold price rises by 1% , the customer can make a profit of 100 yuan; conversely, if the gold price falls by 1% , the customer will lose 100 yuan.

Investors pay a certain amount of margin to the dealer to open a reference target CFD. If the price of the target asset rises or falls, the investor will make a profit or loss due to the price change . Compared with traditional products such as stocks and commodities, CFD trading can be based on the price trend in any direction .

For example, if the price of Apple's stock is expected to fall, investors can take a short position and open a short contract. Once the stock falls as expected, investors can settle the contract at any time, which is called closing the position. The difference between the price when the contract is closed and the price when the contract is opened is the profit, and vice versa.

Leverage is another feature of CFDs, which means that investors do not need to invest the full cost, but can still obtain a full contract/position. Leverage can magnify potential gains, but it should be noted that potential losses will also be magnified at the same time, so risk management must be properly performed when investing.

When the leverage ratio is 1:100, investors only need to pay a margin of 100 yuan to purchase any CFD equivalent to 10,000 yuan in the market.

CFD is a non-deliverable contract, that is, the product in the contract will not be physically delivered , and only the cash settlement of the price difference will be made during settlement. Therefore, CFDs are theoretically unlimited, and positions can be held indefinitely until investors close their positions. However, some contracts still specify an expiration date, and investors must close their positions before the expiration date, otherwise the dealer will force the contract to close .

The profit of CFD comes from the price at the time of opening the contract and the difference at the time of settlement (closing the position) . In theory, if the purchase price plus the cost of the traded product is lower than the selling price, there will be a profit, otherwise there will be a loss.

Buying price + cost - selling price = profit/loss

The above are the basic trading principles, and the cost of purchasing CFDs directly affects whether the investment is profitable. The following will explain the various costs when investing in CFDs.

Image source: ws-alerts.com

There are three types of costs for CFDs: spread, swap and commission.

When buying CFDs, investors need to pay the spread, which is the difference between the buy price and the sell price at that point in time . For example, when opening a long gold contract, the sell price is 1730 and the investor opens a contract at the buy price of 1750, then the spread of the gold contract is 20 yuan. (The spread cost is included in the buy price and sell price, and is not applicable to the above formula, otherwise it will be double calculated)

At the end of each trading day, all positions held overnight are subject to swap transactions. The overnight interest to be paid or charged is calculated based on the transaction direction and the corresponding interest rate. (It will be adjusted from time to time)

The above picture shows the overnight interest rate of UACTCTK gold. Taking this as an example, if an investor holds a long position of gold and holds it until the next trading day, he will need to pay 5.46 yuan. If he holds a short position, the investor will be charged 2.16 yuan.

Commission : Depending on the trading conditions of different platforms, different commission amounts will be charged independently for each transaction.

Given that CFDs have a more complex product structure and a shorter history than traditional investment products, current CFD issuers and traders conduct their business under the supervision of financial departments in major countries such as the United Kingdom, Germany, Switzerland, Australia, and Switzerland to ensure the legality and stability of their business. Therefore, when choosing a trader, investors must choose a trader with legal supervision to ensure the security of transactions and funds.

The following four are the most authoritative institutions that conduct strict audits and supervision on brokers:

UACTCTK is strictly regulated by the UK FCA to conduct legal operations of CFDs and provides more than 100 CFD products, including foreign exchange, stocks, indices, commodities and gold, for investors to invest online in a fair and just environment.

Currently, most financial products that can be traded using CFD include foreign exchange, stocks, indices, commodities, and cryptocurrencies , with a total of more than 2,500 trading products. The following are common product types:

Certain varieties require special attention due to their characteristics:

CFDs for foreign exchange margin trading are the most mainstream trading products. Their value depends on the exchange rate of different currencies. For example, the value of EURUSD is the exchange rate of 1 Euro to the US dollar. Internationally, the US dollar is used as the unit of expression for the profits and losses of all currency pairs . For example, the profits and losses of GBPJPY are not expressed in Japanese yen but in US dollars.

In addition, stock CFDs do not enjoy any voting rights or interest rights enjoyed by ordinary shareholders at the company's annual general meeting of shareholders . Buying and selling CFDs will not directly affect the price changes of the underlying stocks. Therefore, investors can only passively accept the results of the company's decisions without any ability to influence prices. The platform will also adjust the price of CFDs on the dividend payment date to reflect the impact of interest on the price of CFDs.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.