The unique feature of foreign exchange trading is its 24×5 (Monday to Friday, 24 hours a day) trading time. Since the foreign exchange market is spread all over the world, there are fluctuations and trading opportunities in any time period, and the exchange rate fluctuations of various currencies are different in different time periods. Therefore, we will explain to you how foreign exchange investors can choose the trading period that suits them best.

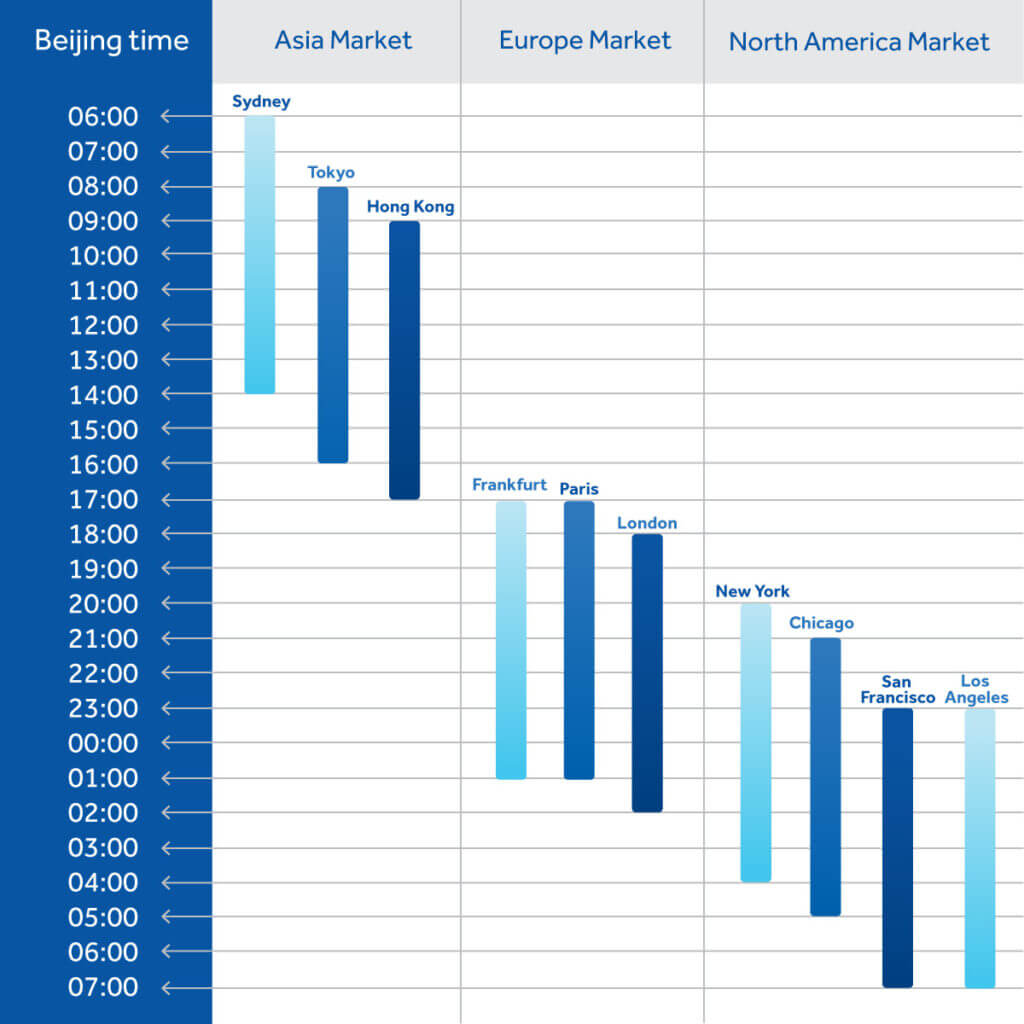

At present, there are about 30 major foreign exchange markets in the world, which are spread across different countries and regions on all continents. According to the traditional geographical division, they can be divided into three major parts: Asia, Europe, and North America. Among them, the most important ones are London, Frankfurt, Zurich and Paris in Europe, New York and Los Angeles in the United States, Sydney in Australia, Tokyo, Singapore and Hong Kong in Asia, etc. Due to the time difference between regions, the markets in various places are connected to each other uninterruptedly. The foreign exchange market is also open from Monday to Friday, and the global market is closed on Saturday and Sunday. It will not be until 5 am on Monday Beijing time (GMT+8) that New Zealand will open the market first.

Please note that the fluctuation time of each currency pair may be different. Generally speaking, the local currency will be more active during the trading hours of the local market . For example, in New Zealand and Australia in the Asian region, the Australian dollar and the New Zealand dollar are generally more likely to fluctuate greatly during the Asian morning session, while the European and American currencies are naturally concentrated in the evening of Taipei time. This is also due to the time when economic data are released in different regions.

On the other hand, since the United States is the leader of the global economy, the overlapping trading hours of the U.S. and European markets (referred to as the European and American hours), from 8 pm to 1 am , are the peak of market trading , and the exchange rate is most likely to fluctuate significantly. This time period is also very suitable for Asian traders who have just put down their work, which is a clear advantage for amateur investors.

If traders in Asia do not need to be distracted by work, they can start as early as 3:00 or 4:00 p.m. Beijing time, grasp the time period when market trends are more likely to occur, analyze the market conditions, and make the best deployment.

Foreign exchange trading is around the clock and is roughly divided into three time periods. Let's take a look at the three time zones:

As market trading becomes more active, there is a greater chance of seeing trends, signs of change, or even breakthroughs.

Because all major banks conduct transactions, it is the most frequent time of the day. In addition, Europe, the United Kingdom and the United States will release economic data, market volatility will increase, and it is also the time with the most block transactions, and the market trend may be most obvious.

During the more active trading period of the week, as the market begins to digest factors from different channels, the ups and downs are more stable and there are fewer disorderly fluctuations.

Avoid holding positions into the weekend, because during the market closure period, there may be some unexpected news, and the trading risk is relatively high at this time

Some major banks are closed, which may lead to quiet trading and occasional exchange rate volatility. Therefore, it is not advisable to trade.

Some major events often cause the market to lose order temporarily, which takes time to digest. The fluctuations during this period will increase the risk of entering the market.

Choosing a better time period for trading is only a small trick in foreign exchange trading, not a key point to win. If you want to make money more certain, you should still keep observing and analyzing the market and master it.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.