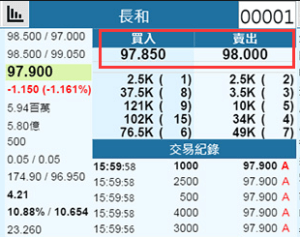

When trading, novice investors should note that the buying and selling prices of currency pairs are inconsistent. This is quite normal. For example, in the real-time quotes of the stock market, there is also a price difference between the buying and selling prices of stocks.

In the foreign exchange market, the (smallest) unit used to quantify fluctuations in currency quotes is called a pip, so the difference between the buying and selling prices is called the "spread". Generally speaking, for EUR/USD, the fourth decimal place is 1 pip, and because of the currency value of the Japanese yen, such as USD/JPY, the second decimal place is 1 pip.

For example, when the EUR/USD exchange rate rises from 1.1840 to 1.1849, we can point out that the EUR/USD has risen by 9 pips. In addition, the current spread quoted by most foreign exchange brokers on EUR/USD is 3 pips or less. This means that, for common contract specifications, the standard unit is 100,000, that is, one lot of EUR is a 100,000 EUR contract, and the cost of the bid-ask spread is calculated at 3 pips to be $30.

EUR/USD

USD/JPY

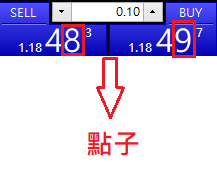

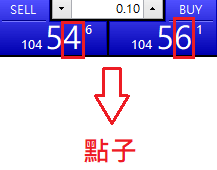

In the traditional foreign exchange market, 1 pip refers to the "smallest unit of fluctuation", but most trading platforms currently display an additional decimal place in the quote, so the definition of a pip may be different.

In fact, this is mainly due to the development history of the financial industry. Since the financial tsunami, technology and communication networks have become increasingly developed, and the amount of information that can be processed at the same time has also increased. In addition, financial companies generally attach importance to technological research and development, and gradually develop to allow different brokers to connect to the foreign exchange market in many ways, making the exchange of data and information faster and closer. The market quotes have therefore become more refined and can be quoted in units of 1/10 that are smaller than 1 point.

This is a good thing for investors, because the spread is narrower in disguise, reducing the cost of trading. To this day, the competition among foreign exchange brokers is still fierce, so they all quote one more point, so over time, the understanding of 1 pip may be different in the market.

Basis Point is also called BP (Basis Point). Investors who are new to foreign exchange may think of it as the concept of "pip". In fact, Basis Point does not appear in foreign exchange transactions because it is used to describe changes in bonds and interest rates.

1 basis point is equal to 0.01%. For example, the Federal Reserve often mentions a 25 basis point increase in interest rates. This basis point refers to the Basis Point, which means a 0.25% interest rate increase. In fact, in addition to Basis Point and Pip, Tick and Point can be translated as "points", but their actual meanings are different. It may be very intuitive to understand them in English, but it is easy to have deviations when understood in Chinese. Investors must not misunderstand.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.