Every investor has a set of accustomed trading methods. Some choose to buy undervalued securities like Buffett and hold them for a long time, and reinvest the compound interest effect (cash dividends or stock dividends) brought by long-term holding to make the capital bigger and bigger; some are keen on short-term or intraday market fluctuations, trying to earn price differences in relatively small value fluctuations and make profits through short-term operations. This method is called short-term trading. Day trading is a common short-term trading model.

Next, I will explain the common strategies and trading suggestions for day trading.

Day trading refers to traders who choose to enter the market on the same day and close their positions on the same day. They are generally regarded as speculators or speculators, also known as "day trading". Day traders usually use a lot of trading strategies and technical analysis to predict market trends, and use leveraged investment to make profits from price fluctuations in a short period of time. Successful day trading also requires strong self-discipline.

To enter and exit the market and earn profits in every fluctuation is the beautiful vision of every day trader. However, statistically, about 72% of day traders lose money, and only about 20% succeed in making profits . What makes these 20% different ? It is not difficult to understand that the most important factor must be excellent trading skills and strategies. Of course, psychological quality is also important. The following are trading strategy suggestions for three common chart patterns:

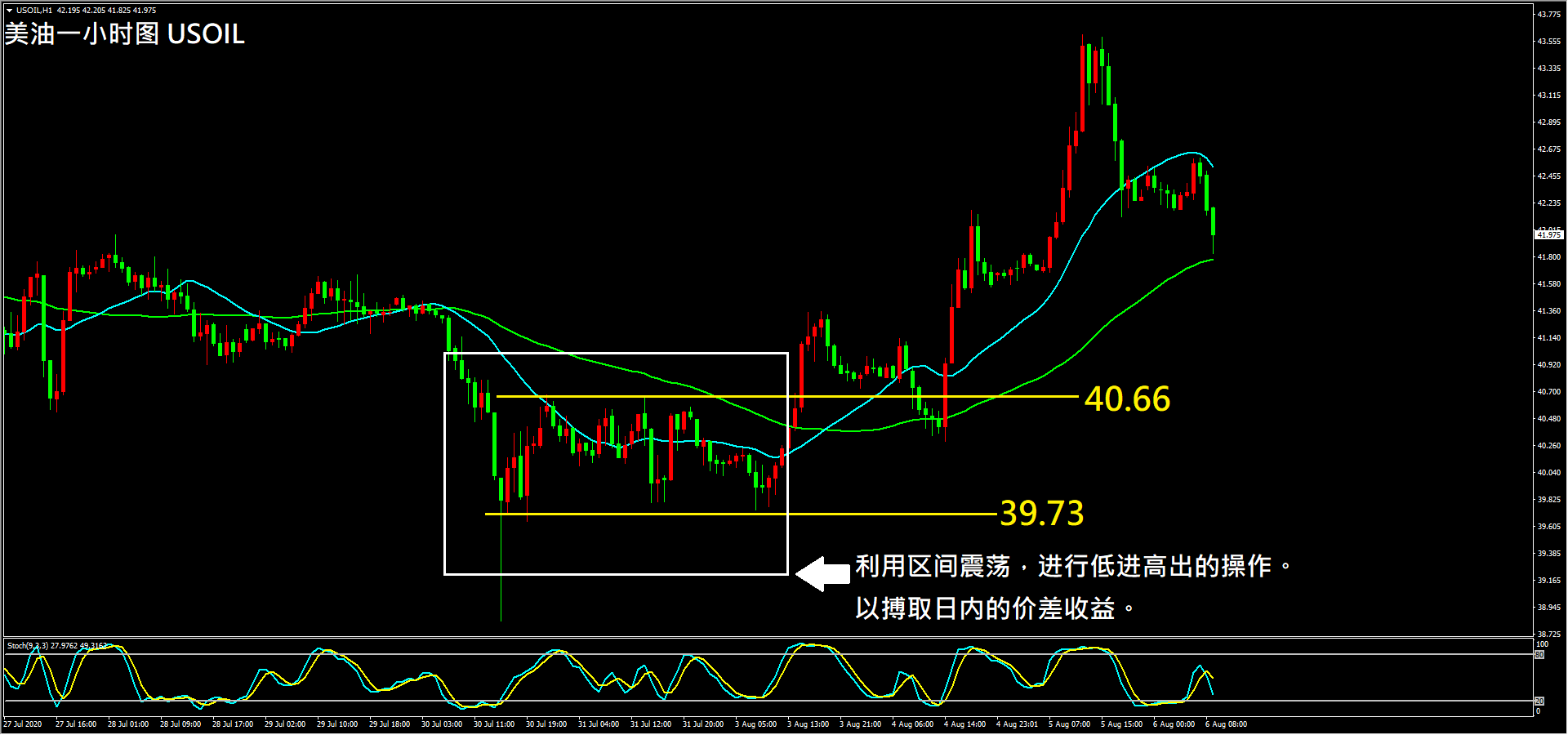

Generally speaking, the market is either rising or falling, but the market is occasionally hesitant, which is called consolidation or shock. Usually professional and experienced analysts or traders will recommend avoiding the market with unclear trends to avoid losses from back and forth sweeps. But in fact, if traders are familiar with or have a grasp of the consolidation range, sometimes they can also use the shock market to carry out spread trading, which is also one of the trends that some intraday traders are keen on.

Figure 1: Range Trading Example

Figure 1: Range Trading Example

As shown in the above figure, oil prices were previously consolidating between 39.73 and 40.66. If you are an aggressive day trader, you can take advantage of the price fluctuations within the range and perform low-long and high-short operations. This is a typical range trading strategy.

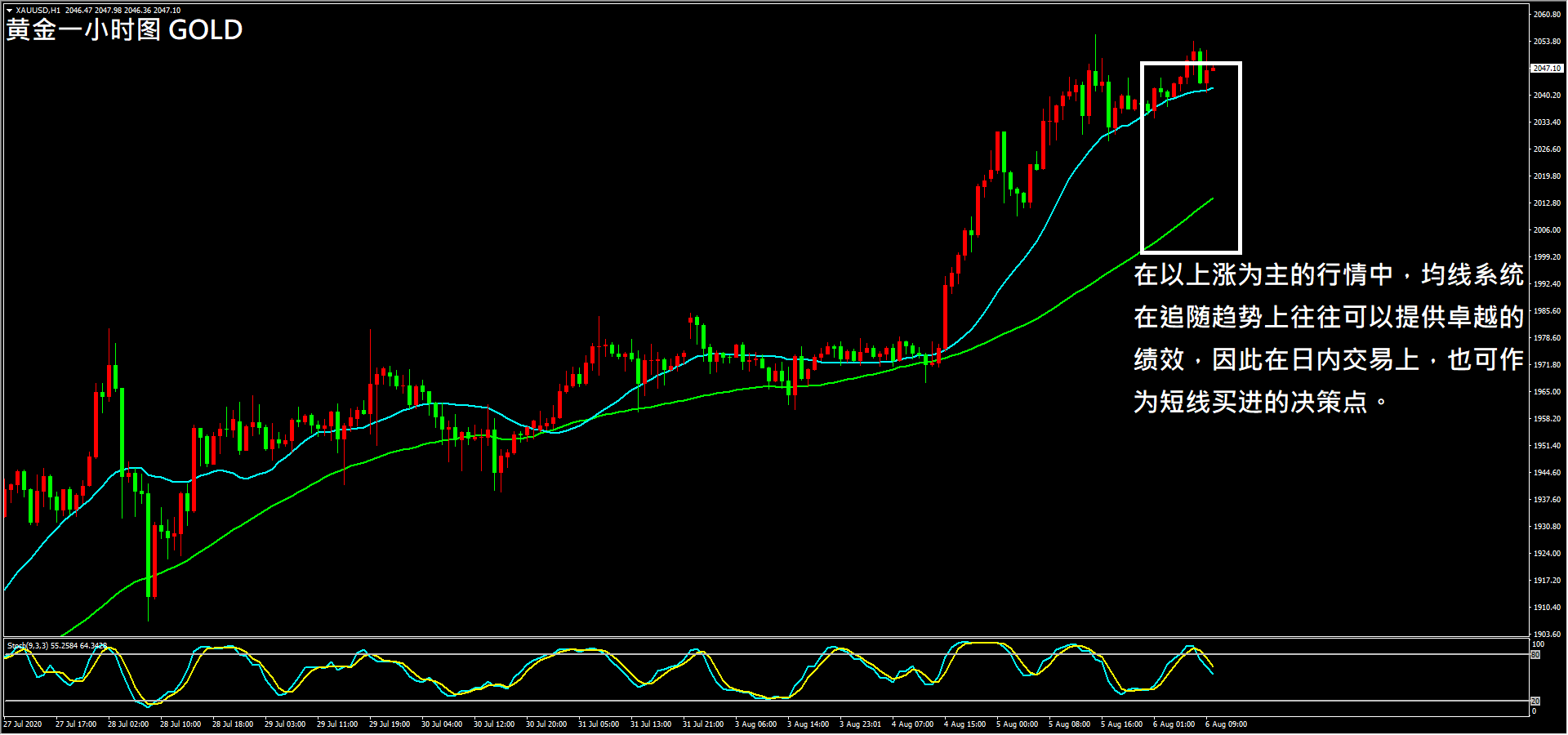

Trend trading refers to trading in the direction of a short-term strong trend. For example, if the short-term fluctuations are mainly upward, we can reasonably infer that the winning rate of short-term long positions seems to be higher, and we can easily make profits by going long in the direction of the trend. The analysis threshold for trend trading is the lowest among all types of transactions, so for newcomers who just want to day trade, learning to trade in the direction of the trend is the most important lesson.  Figure 2: Trend trading example

Figure 2: Trend trading example

As shown in the above figure, if there is a relatively obvious trend on the market, the strategy with the highest winning rate for day traders is to follow the trend. Therefore, technical indicators that track the trend can be used as decision points for short-term trading.

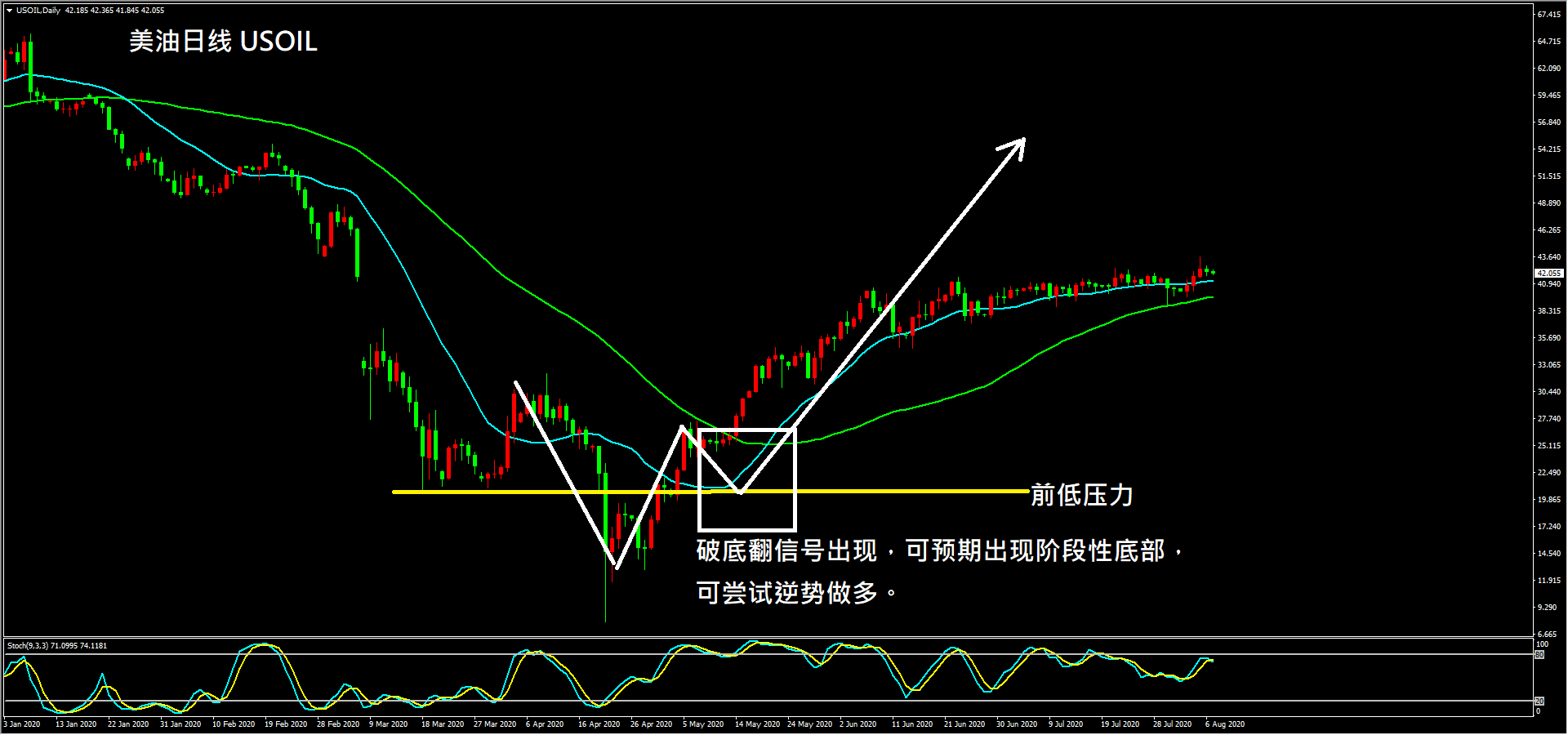

Counter-trend trading is the opposite of trend trading. Intraday traders actively predict the timing of trend exhaustion and make reverse operations. For example, when a top is formed in a bullish trend, they predict the possibility of a subsequent short-term decline and establish a short position. If the trader makes the right judgment, he can get huge profits at any time.

Figure 3: Bottom prediction example

Figure 3: Bottom prediction example

However, since counter-trend trading has the most stringent requirements for technical analysis, if traders are not proficient in technical analysis, they will often suffer losses. Therefore, it is not recommended for novices entering the market to learn it. It should be the last one you learn among all trading types.

No matter what financial product it is, bonds, stocks, options, etc., as long as it is profitable and the capital scale is sufficient, it can become a day trading target. Sometimes, day traders may not be able to operate high-priced stocks or bonds due to the size of their capital. At this time, they can try to use the recently popular CFD contract trading.

CFD has the characteristics of high leverage, which allows intraday traders to use a small amount of funds to leverage large contracts, so it is widely welcomed by retail investors. However, although the profits from high leverage are tempting, the risks are also relatively high. Even if the CFD trading system and capital requirements are more friendly to retail investors, traders should still have sufficient risk awareness and psychological preparation.

相关文章:CFD是什麼?差价合约运作原理, 交易成本, 商品种类全介紹

For day traders, the most important thing is whether there are trading opportunities during the day, so they will choose commodities that are more likely to have obvious fluctuations. Good volatility commodities often have several conditions, that is, the need for liquidity and news.

For example, it is easier to trade the Euro against the US dollar (EUR/USD) than the Indian rupee against the US dollar (INR/USD or USD/INR) . The Euro has more news exposure and greater demand than the Indian rupee, so there are definitely more traders involved. With huge liquidity, the Euro is also more likely to have an ideal trend or predictable fluctuation pattern, allowing traders to formulate good intraday trading strategies.

Among the numerous economic data in each month, there are always a few relatively important ones, such as the often-heard " horror data " of US retail sales, US non-farm payrolls, and interest rate decisions of central banks of various countries. Every week, there are also initial jobless claims in the US or API and EIA crude oil inventory data released by the US. When these data events are released, they may often bring opportunities for large fluctuations in specific commodities.

Therefore, if traders are confident in their ability to judge fundamentals, they can take advantage of these high volatility opportunities to make profits. However, fundamentals are also prone to the phenomenon that bullish news does not lead to price increases, and bearish news does not lead to price declines. There are many global variables, so traders should do a good job of risk control.

Finally, I would like to remind readers who want to engage in intraday trading that due to the high frequency of intraday trading and the extremely short operation cycle, it attaches great importance to the accuracy of technical analysis and the high requirements of psychological quality. If you are a trader with a relatively immature mentality, it is easy to lose your way in intraday trading and make big mistakes. Therefore, it is recommended to carefully measure your own ability before trading.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.