The US dollar is the world's most traded currency with the highest international recognition. Since the establishment of the Bretton Woods system in 1944, the US dollar has gradually become the dominant currency in the international monetary system. Nearly 90% of global currency transactions are related to the US dollar, which has made the US dollar the most important reserve currency in the world. The US dollar is also the most commonly used settlement currency when traders buy risky assets or trade foreign exchange contracts. Even if the market is risk-averse, traders will turn to buying US Treasury bonds, thereby increasing demand for the US dollar.

This article will predict the trend of the US dollar in 2021 based on the past performance of the US dollar and the factors affecting the US dollar exchange rate.

The past trend of the US dollar since the collapse of the Bretton Woods system in 1973 can be divided into three major cycles, and it is currently in the third major cycle.

In 1979 , the US suffered from stagflation due to the oil crisis. The Federal Reserve and the White House jointly adopted a "tight monetary policy + loose fiscal policy" to save the market. At the same time, they controlled the money supply and pushed the interest rate (Effective Federal Funds Rate, EFFR) to a historical high of 22.36 % in 1981. From 1979 to 1985 , the US dollar was too strong, which led to a sharp increase in the trade deficit. In particular, the manufacturing industry that relied on exports was hit hard, which led to the Plaza Accord signed between the United States and other countries in 1985 to solve the trade deficit problem. However, the US dollar also began to depreciate, and it was not until December 1987 that it stabilized.

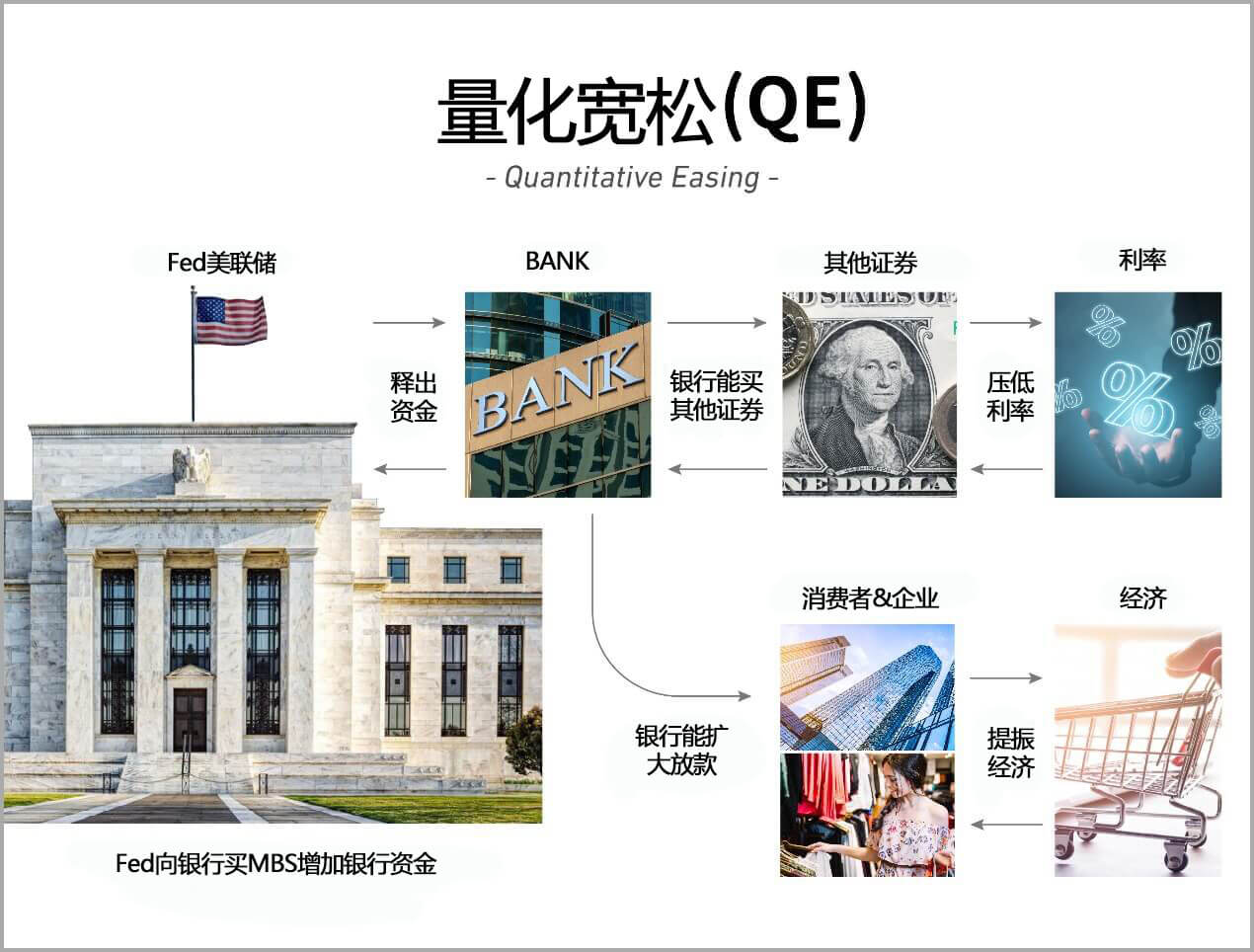

Figure 1: What is quantitative easing?

From 1993 to 2000, the average annual growth rate of US GDP reached 3.5%-4%, the inflation rate dropped to around 2%, and the unemployment rate dropped from 7.4% in 1992 to 4.1% in May 2000. From this data, we can see that the strengthening of the US dollar during this period was based on its strong fundamentals.

However, after the bursting of the Internet bubble and the 9/11 terrorist attacks in 2001, the market became cautious about the US economic outlook, and economic growth began to slow down. In addition, the Federal Reserve adopted loose monetary policies from 2000 to 2003, which led to the dollar's depreciation again. Although the Federal Reserve began a new round of interest rate hikes in 2004, it failed to stop the dollar's decline.

The situation took a turn for the worse in 2007. The rise in interest rates was the fuse of the subprime mortgage crisis, which indirectly triggered the global financial crisis in 2008. The US dollar suddenly appreciated as a safe haven for funds. The Federal Reserve then announced the implementation of the "quantitative easing" monetary policy in 2009, increasing the money supply base and suppressing the trend of the US dollar.

The United States implemented three rounds of "quantitative easing" policies from 2009 to 2014, and began its exit mechanism in 2014. At that time, the world had not yet escaped from the storm of the global financial crisis in 2008, but the United States had taken the lead in getting out of the storm due to its strong economic foundation, allowing the US dollar to regain its upward trend. The Federal Reserve began a monetary policy of slowly raising interest rates in 2015, and it was not until the first quarter of this year (2020) that the outbreak of the epidemic forced the Federal Reserve to once again launch a new round of monetary easing policies.

After the outbreak of the COVID-19 pandemic in the first quarter of this year, the Federal Reserve began the largest-scale money printing in history. The market has always had a strong interest in the subsequent trend of the US dollar. This chapter will analyze the recent trend of the US dollar based on the Federal Reserve’s monetary policy, US economic fundamentals, and market risk aversion.

Since the outbreak of the epidemic and the collapse of oil prices in the first quarter of this year, the global economy has been harmed, and future development is full of high uncertainty. At this time, the US dollar has shown a strong safe-haven attribute, causing the global currency market's demand for the US dollar to soar, and its liquidity has been greatly tightened. In order to provide sufficient liquidity support for the US dollar, the Federal Reserve at that time started the "zero interest rate + unlimited QE" monetary easing mode, and successively launched PMCCF (primary market corporate credit support tool), SMCCF (secondary market corporate credit support tool), PPPLF (wage guarantee liquidity tool) and Main Street Lending Program and other unconventional monetary tools, so that the US dollar liquidity has not been scarce so far, but what followed was a significant increase in the size of the Federal Reserve's balance sheet, and according to recent meeting minutes, it can be learned that the view on future monetary policy continues to be dovish, and the market also expects the Federal Reserve to continue to print money indefinitely to suppress the US dollar trend.

The fundamentals of the U.S. economy are also an important factor affecting the strength of the U.S. dollar exchange rate. Judging from the recent performance of U.S. fundamentals data, the United States has indeed achieved the goal of "coexistence of work and virus". Although it suffered a resurgence of the epidemic at the end of June, fortunately its economic growth rate has not stagnated. From the detailed data, it can be seen that the current U.S. economic recovery is led by the manufacturing industry, and the service industry is slightly behind due to population contact. However, compared with Europe, which has been hit hard recently, the fundamentals of the U.S. economy are relatively good, which also has a certain supporting effect on the strength of the U.S. dollar.

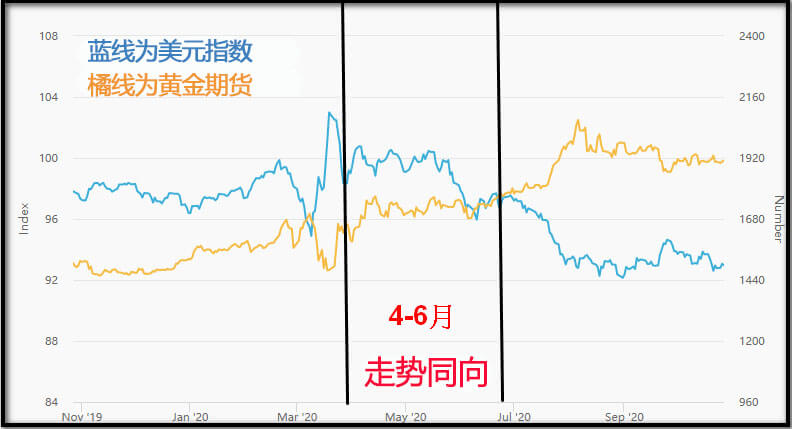

The U.S. dollar has shown its strong safe-haven properties during this epidemic, so the market's risk aversion sentiment will continue to affect the U.S. dollar. Looking back at the previous trend of the U.S. dollar and gold, in March, when the COVID-19 outbreak and oil prices collapsed, global stock markets plummeted, the VIX panic index soared, and funds poured into safe-haven assets. However, due to concerns about the financial market, investors abandoned traditional financial safe-haven assets (such as Japanese yen, gold, etc.) and turned to holding cash U.S. dollars, causing a tightening of U.S. dollar liquidity and triggering a "dollar shortage" in the currency market. The U.S. dollar index has also soared.

Fortunately, from April to June, the Federal Reserve's active rescue efforts were effective, and dollar liquidity was finally eased. However, the economic fundamentals of various countries affected by the epidemic began to emerge, and investors' concerns shifted from financial markets to the real economies of various countries. During this period, the U.S. dollar index and gold futures prices moved in the same direction. Both remained strong at high levels due to their safe-haven nature. Although their trends began to show a high negative correlation again in July, given the safe-haven value of the U.S. dollar during this epidemic, risk aversion is still one of the factors that cannot be ignored for its subsequent trend.

Figure 2: Trends of the US dollar index and gold futures over the past year

Throughout 2020, due to the impact of COVID-19, global retail sales declined, manufacturing orders decreased, and the service industry in various places declined rapidly due to epidemic prevention regulations, resulting in the worst economic recession in history.

In order to mitigate the impact of the epidemic on the economy, countries have successively introduced generous fiscal measures, and central banks have cut interest rates. The Federal Reserve has even lowered interest rates to the lowest range (0%-0.25%) in one go, hoping that loose policy support can stimulate the sluggish economy.

Although the global economic crisis once made the US dollar popular among safe-haven funds, the governments and central banks of various countries have taken a two-pronged approach of fiscal and monetary policies, and investors' nervousness seems to have eased. Market sentiment has gradually become optimistic, which has also made investors refocus on risky assets such as stocks and re-buy value stocks that have been greatly undervalued during the epidemic. With the overall risk aversion demand weakened, the pressure for the US dollar to depreciate has gradually emerged.

In the fourth quarter of 2020, the dust settled on the US presidential election, and investors gradually became aggressive. In addition, biotech giants such as Pfizer, AstraZeneca and Moderna have successfully developed COVID-19 vaccines, which has made the stock market trend even more prosperous. The US stock market has hit record highs one after another. In an environment with full risk appetite, continuing to hold US dollars does not seem to be a good choice.

Furthermore, most experts expect the impact of COVID-19 on the US economy to last for a year, which means that the economy is not expected to improve significantly until the winter of 2021, which means that during this period, the US government must maintain spending, subsidies and relief measures. The huge deficit is expected to be difficult to recover in 10 years, or even not recoverable, and the Federal Reserve will be forced to maintain low interest rates and significantly increase government spending to facilitate economic recovery.

The Federal Reserve has already introduced a new interest rate hike standard, the "average inflation mechanism", and the market expects the Federal Reserve to maintain low interest rates until 2023. With the excessive circulation of US dollars, it is unlikely that the US dollar will effectively strengthen in the next one or two years, and it is even reasonably expected that the probability of a bear market is absolutely high.

Figure 3: US dollar weekly chart

From a technical perspective, the U.S. dollar weekly line failed to break through the previous high after several pull-ups, and retreated downward to break through the moving average support. It was suppressed downward after the 20 and 60MA crossovers, and the high and low points of the band also moved downward one after another. The short-term selling pressure was relatively heavy. Although the weekly KD indicated a rebound signal, investors should pay attention to its rebound momentum. If it can break through the previous high of 94.81, there is hope for a strong rebound.

On the contrary, if it fails to break through 94.81, the bears may regroup, causing the trend to fall under pressure and challenge the previous low support of 88.34. If the bottom is broken, the decline will accelerate, otherwise the US dollar will usher in a longer period of volatility.

As the world's most liquid currency, the U.S. dollar has long been a popular investment project around the world. Here are a few ways to invest in the U.S. dollar:

Foreign currency account trading is a more conservative investment method, but it requires opening a local currency account in advance to make the exchange. If the US dollar exchange rate is expected to strengthen in the future, investors can observe the bank's reported exchange rate and buy US dollars into the foreign currency account at a low price. When the US dollar strengthens as expected, they can sell the US dollars at a high price. The difference in local currency converted is the profit.

Related articles: Three major functions of foreign currency accounts Simple account opening process tutorial

There are also products related to the US dollar index in the futures market for investors to trade, but it should be noted that futures trading has a time limit. If the position is not closed on the last trading day, delivery must be made. Some futures contracts (such as the US dollar index and stock index) do not have physical or actual financial products to deliver, so cash settlement will be made based on the difference between the spot price and the settlement price on the last trading day.

At present, the most popular trading on the market is the contract for difference (CFD). CFD is a derivative investment tool that allows investors to trade various types of underlying assets such as stock indices and commodities. By trading CFD, investors can conveniently invest in the underlying assets of their choice. The concept is that the buyer and the seller enter into a contract, and the profit and loss come from the price changes of the underlying assets in the contract. The two parties to the transaction only make cash settlement of the price difference and do not need to actually hold the underlying assets. Its convenience and the characteristics of both long and short positions being profitable have attracted the attention of investors around the world, and CFD trading has become more and more popular.

Therefore, through CFD trading, if traders are optimistic about the trend of the US dollar index, they can choose to go long on USD/JPY or short on AUD/USD in the currency pairs of the foreign exchange market; but if they are not optimistic about the trend of the US dollar, they can also choose to go long on EUR/USD, GBP/USD or short on USD/CAD. Another way is to go long on US dollar-related CFDs directly, such as the US dollar index CFD.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.