Stop loss means that when a transaction loss reaches a predetermined amount or reaches a certain price, you choose to exit the market. This is a risk management approach, and the main purpose is to control the loss within a certain range. From an investment perspective, a wrong investment can lose everything at any time. In order to avoid the risk of large losses, setting a stop loss is to control the investment risk as much as possible.

投资有赚有赔,止赚就是指当我们在获利的行情时,指当一项交易的利润已达预定的金额或到达某个价格时,同样选择离场,落袋为安。以投资的角度来说,行情永远不可能向有利的方向走,也不可能完全预计得到甚么时候会逆转,为免错失出场良机,止赚的设置就是让交易者尽可能捕捉最佳的出场点。

You can't always monitor the trend during trading, so the current online trading platforms allow you to set orders in advance to help you master the entry and exit points. Here are the most popular MT5 platform order types.

Market orders are the simplest, executing buy or sell orders at the current market price. Note that the market price may change very quickly, and sometimes the price seen by the trader may not be exactly the price at which the order is finally executed, and there may be some errors.

A pending order is a buy or sell order that a trader sets in advance at a specific price. When the market reaches the preset price, the pending order will be automatically executed at the current market price. In fact, stop loss and stop profit are both pending orders, defined as Stop Order and Limit Order respectively, attached to the trader's position.

However, when the trader does not hold a position, pending orders can be divided into two types:

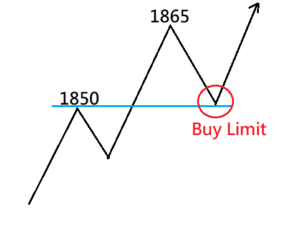

When traders want to buy at a price lower than the market price, or sell at a price higher than the market price, they can use the limit order function. For example, the current price of gold is 1865, and traders expect that a new round of gains may occur when the price falls back to around 1850. Traders can choose to pre-place a limit buy order (Buy Limit) at 1850. When the price falls back and touches this price, the order will be executed and converted into a market buy order at 1850. So generally speaking, limit orders are also used in "buy on callbacks and short on rebounds" transactions.

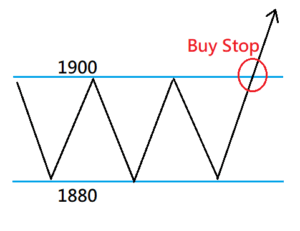

Stop orders are also called breakout trades. If traders believe that when the price breaks through a certain level, there may be a greater rise/fall, they can use this type of order to "chase long and short". For example, the current price of gold is 1890. Traders believe that when the gold price breaks through 1900, there will be an upward trend. Then traders can pre-hang a stop-loss buy order (Buy Stop) at 1900, which is higher than the market price. When the price rises and reaches this price, the order will be executed and converted to a market buy order at 1900.

Stop loss, take profit, pending orders, etc. are all part of the trading strategy. Under the premise that it is impossible to monitor market fluctuations for a long time, traders can use settings to strive for more favorable prices, improve their winning rate and manage risks.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.