The gold-silver ratio has surged recently, attracting the attention of investors. In this article, we will explain what the gold-silver ratio is, its historical trend, the meaning of a high or low ratio, and its importance to investors.

The Gold-Silver Ratio refers to the price ratio of 1 ounce of gold to 1 ounce of silver, that is, how much silver can be bought with the same amount of gold. Generally speaking, gold and silver are both classified as precious metals, so most of the time their trends are the same. However, at certain times, due to the influence of some fundamental factors, the rise and fall of the two are different, and the calculated gold-silver ratio is different. Therefore, the gold-silver ratio, like general prices, is always floating up and down.

So, what factors cause the different levels of volatility in gold and silver ?

Figure 1: Historical price trends of gold and silver

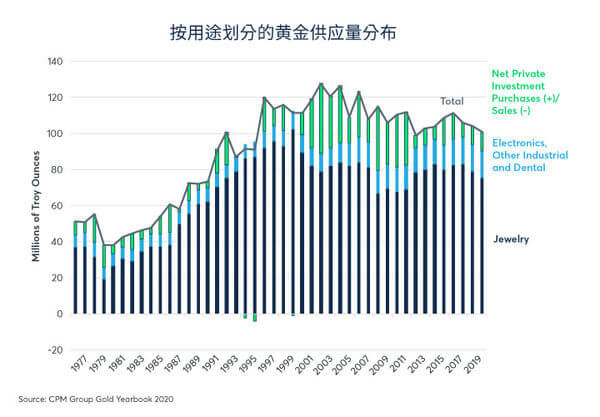

First, we need to know the uses and needs of gold and silver. Gold has been a symbol of nobility and power since ancient times, so the biggest use of gold is still as jewelry and investment demand. In the electronics industry, manufacturing and industry, gold is used less frequently because it is expensive.

Figure 2: Gold supply distribution by use

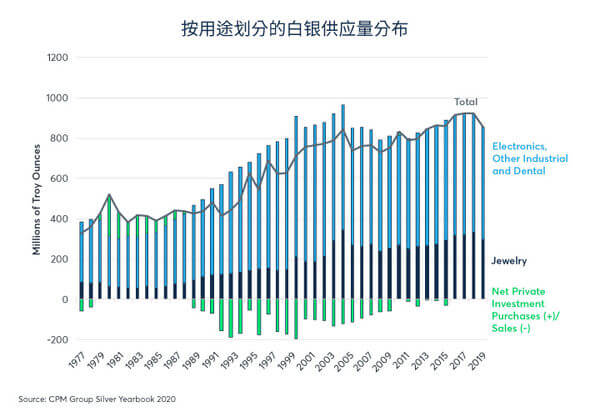

Silver is different. It plays a pivotal role in industrial demand. Among the precious metals, silver has the best conductivity, so it is widely used in the industrial field. This also means that compared with gold, the price of silver is more easily restricted by the economic cycle.

Figure 3: Silver supply distribution by use

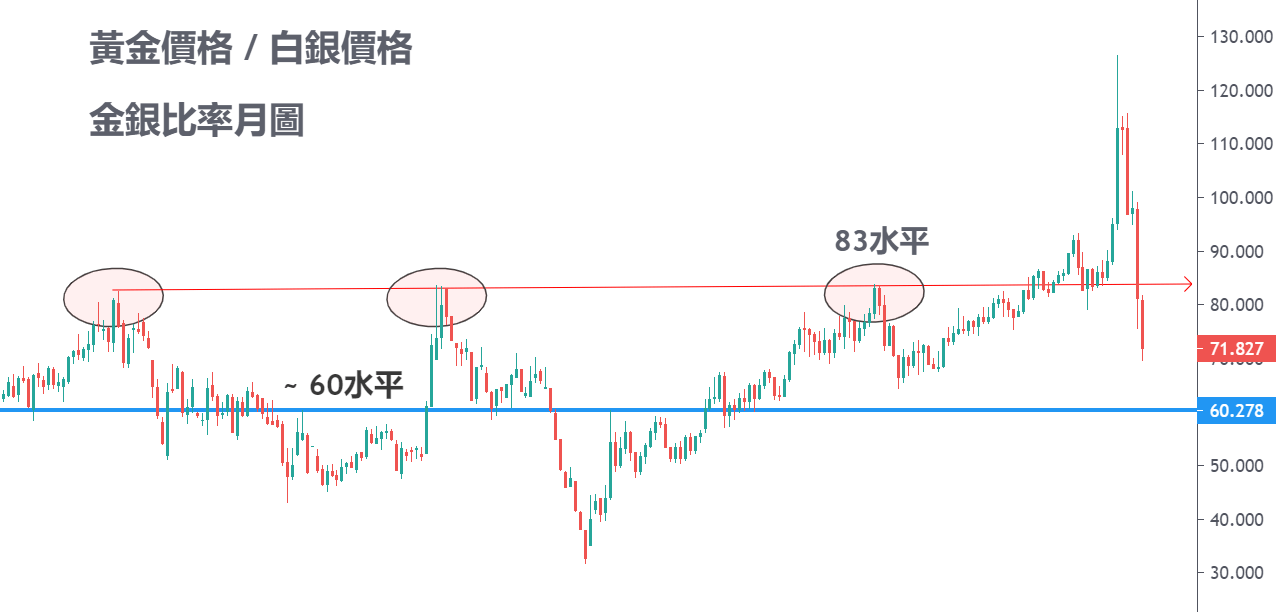

Figure 4: Historical Levels of the Gold-Silver Ratio

Judging from the past gold-silver ratio, a more reasonable ratio is around 60, and the peak value is about 80, which means that when the gold-silver ratio reaches around 80, it is prone to fall.

It should be noted that, for example, a rise in the gold-silver ratio does not necessarily mean that the gold price has risen or the silver price has fallen, but mainly because the increase or decrease of the two is different. Even if both gold and silver fall, but the decline of gold is smaller, the gold-silver ratio can also rise. On the other hand, a decline in the gold-silver ratio may mean that the increase in gold prices is not as strong as that of silver prices.

As explained above, the gold-silver ratio is like general price fluctuations, similar to the exchange rate between currencies. Due to the different characteristics of gold and silver, there is often a difference in the rise and fall of gold and silver. Let's first consider a few factors:

When will the price of gold become more expensive ? Gold is considered a traditional safe-haven asset, and a surge in gold prices often indicates the possibility of a financial crisis. Moreover, countries around the world are currently inclined to boost their economies by printing money, so when the economic environment is bad, gold often rises against the wind because of its value preservation.

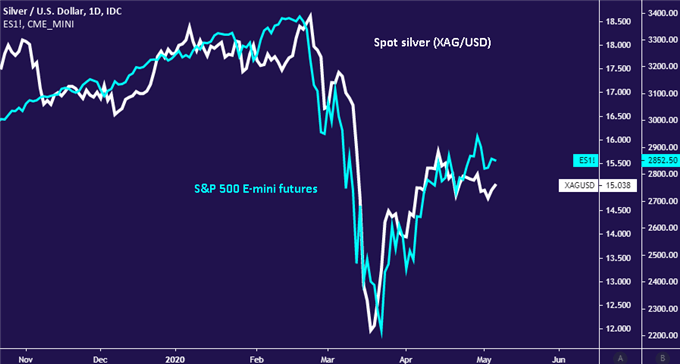

As for the usage of silver, it is still dominated by industrial demand. This makes silver behave like risky assets such as stocks. For example, when the economic situation is bad, the activities of manufacturing and industry will be greatly reduced. At this time, the market demand for silver will decrease, and the price of silver will be easily suppressed. In addition, there are also non-economic incentives. For example, traditional cameras, traditional photography used to require silver as a catalyst. However, with the increasing development of digital photography technology, the traditional photography industry is also declining, and the demand for silver will naturally decrease.

Figure 5: Silver price performance and S&P futures index

From the above chart, we can see that the performance of silver prices is roughly the same as that of the S&P futures index, which confirms the sign that silver is prone to rise and fall due to economic cycles. We can say that the price of silver has a function similar to that of industrial metals such as copper and iron, which serves as a barometer of economic conditions. However, the price of silver still has a certain hedging function to a certain extent, so the price of silver is often driven by the price of gold. If the price of gold rises or rises sharply, the price of silver will also rise, and it may be less referenceable in terms of economic indicators.

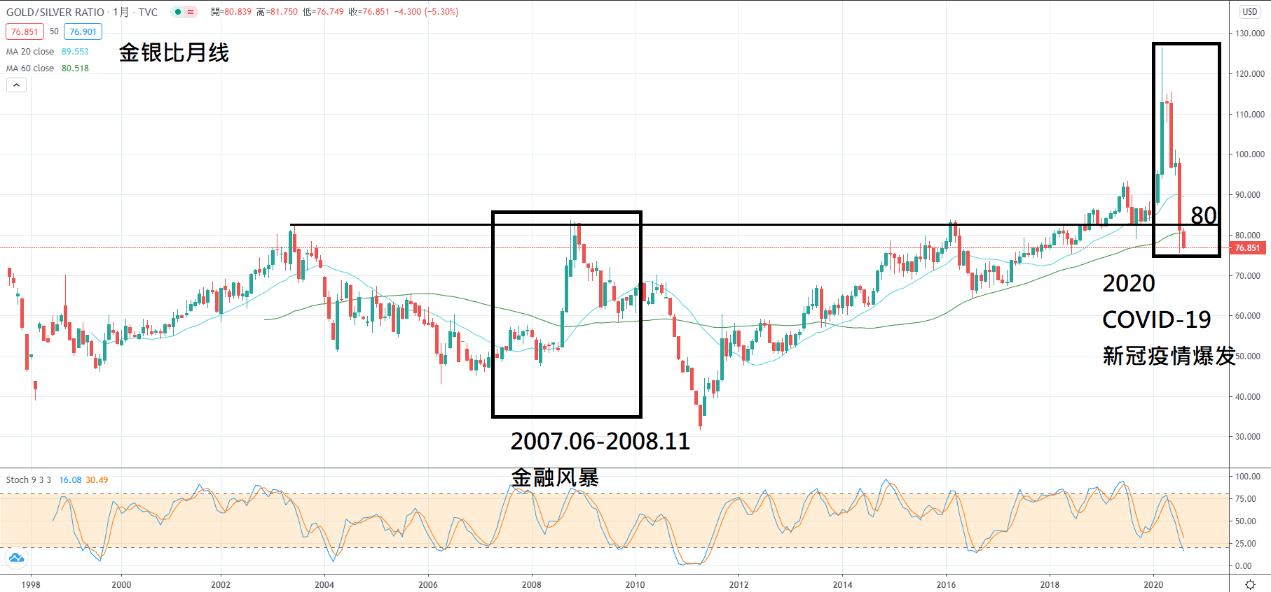

Figure 6: Past times when the gold-silver ratio increased

As can be seen from the above figure, the gold-silver ratio surged in June 2007 and early 2020, and both of these occurred when the financial market was experiencing turbulence, namely the financial tsunami and the COVID-19 pandemic. This reflects that when there is systemic risk in the macro environment, the gold-silver ratio tends to soar.

The main reason is that when there is a crisis in the financial market and the real economy has major problems, the industrial demand for silver may be sharply affected, dragging down the price of silver. However, gold can rise due to the support of safe-haven demand, or its decline may not be as rapid as that of silver. Therefore, the gold-silver ratio tends to rise during these crisis periods.

At the beginning of 2020, the global COVID-19 outbreak caused a sharp drop in economic activities, which led to a sharp drop in silver prices and a sharp rise in the gold-silver ratio. However, silver subsequently followed the rise of gold as a safe haven, and with the global rescue efforts to boost economic demand, silver prices even rebounded, exceeding the gold price. This explains why the gold-silver ratio experienced sharp rises and falls in 2020.

In terms of past fluctuations in the gold-silver ratio, a ratio of 60-80 is also considered a reasonable range. Once the gold-silver ratio exceeds 80, it means that there is a strong demand for risk aversion in the market, which is an indicator of the direction of the market . Some traders will use the characteristics of the gold-silver ratio to assist their own transactions. In addition, once the ratio rises sharply, there is a possibility of downward correction, which reflects that the gold price may be overheated and prone to adjustment, or it may be that the risk aversion sentiment subsides and the silver price rebounds. For more aggressive traders, after the gold-silver ratio exceeds 80, that is, when the gold price is relatively strong, they speculate short gold and long silver. (Note that this is a hedging strategy and must be carried out under the same total contract value of gold and silver.) As long as the gold-silver ratio falls, traders can make a profit.

Of course, there are more detailed reasons for the fluctuation of the gold-silver ratio, such as the total market value of gold and silver, the degree of speculation, etc., which will not be discussed here.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.