The foreign exchange market is as fast-changing as most financial markets. The exchange rate can change dramatically every minute, which makes every trader in the market tense all the time. But from another perspective, this is not a bad thing. If the price fluctuates too little or even does not move, there is no room for profit. As the saying goes, there are opportunities as well as dangers. A trader is not afraid of the fluctuations brought by the market, but what he fears most is the "slippage" that often accompanies the fluctuations. This article will explore the causes of slippage and how to reduce it.

When the order set by the trader on the trading platform triggers a transaction instruction, such as a market order, a stop-loss order, or a limit order, the platform system will throw the order out of the market. If the market price changes at that moment, according to the general transaction logic, the transaction will be completed at the best and latest price. At this time, the transaction price is often slightly different from the price expected by the trader, and this price difference is collectively referred to as "slippage" in the foreign exchange market.

Slippage is a normal phenomenon that occurs during trading. It mainly occurs when the price set by the trader's instruction is inconsistent with the market price of the transaction at that time when the market fluctuates, especially when it rises and falls rapidly.

In the foreign exchange market, under normal market conditions, there will be no obvious slippage problem 99% of the time. So why does slippage occur ? There are three reasons for slippage:

Intuitively speaking, it is the execution speed of the trading platform. Generally speaking, the quotes obtained by traders come from major liquidity providers in the market, and then displayed on their trading platforms. When the market hits the price set by the trader's order ( whether it is a market order, a stop-loss order or a limit order, etc. ) , the platform will send the order, and there will definitely be a period of data transmission time ( measured in milliseconds ) , and this time will always produce a little error.

Throughout the entire process, whether it is from traders to the platform, or from the platform to the market, in the transmission on the Internet, or in the processing on hardware such as the server, there will always be delays. Especially when the market fluctuates, when multiple orders are matched at the same time, the so-called " network congestion " may occur , causing the transaction time to be delayed, resulting in a difference between the final transaction price and the price expected by the trader.

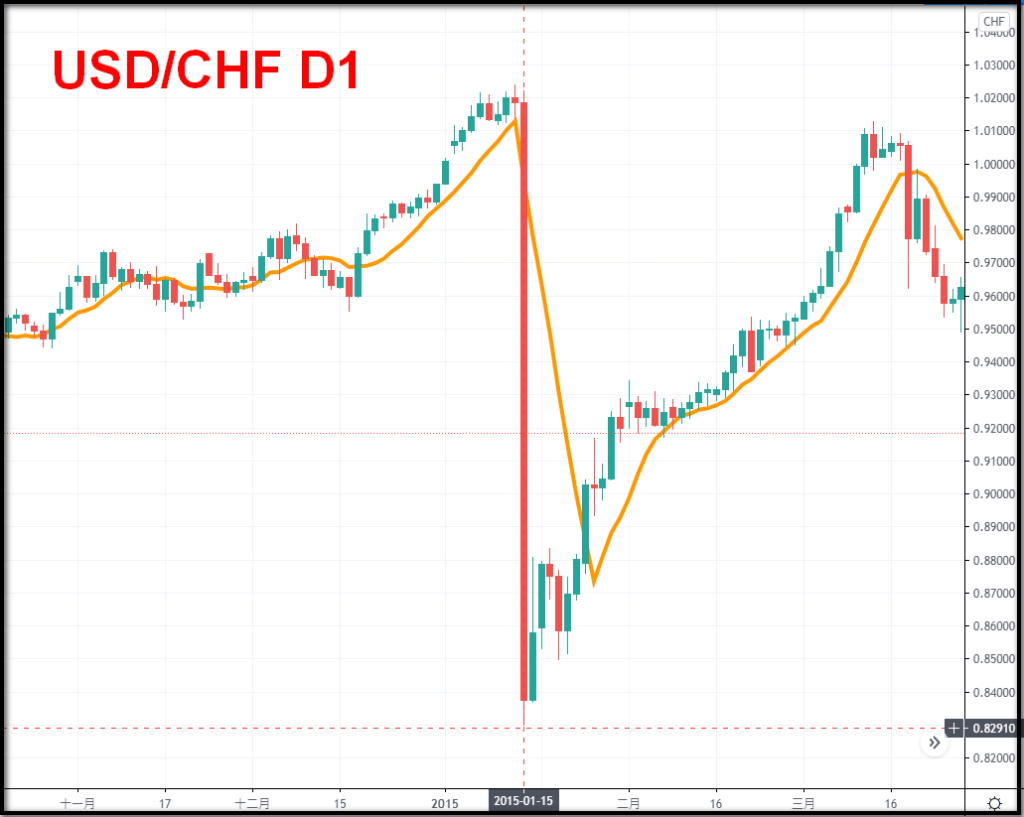

When the market price fluctuates too much, the frequency of slippage will be very high. When there are some breaking news, such as major events, or when some important economic data are released, the trading volume in the financial market will drop sharply, leading to problems such as widening market spreads and more volatile price trends. At this time, the trader's order usually cannot be executed at the expected price, because the price has run away in a very short time, or it cannot be undertaken due to insufficient trading volume.

Figure 1: Market fluctuations of the Swiss Franc Black Swan event on January 15 , 2015

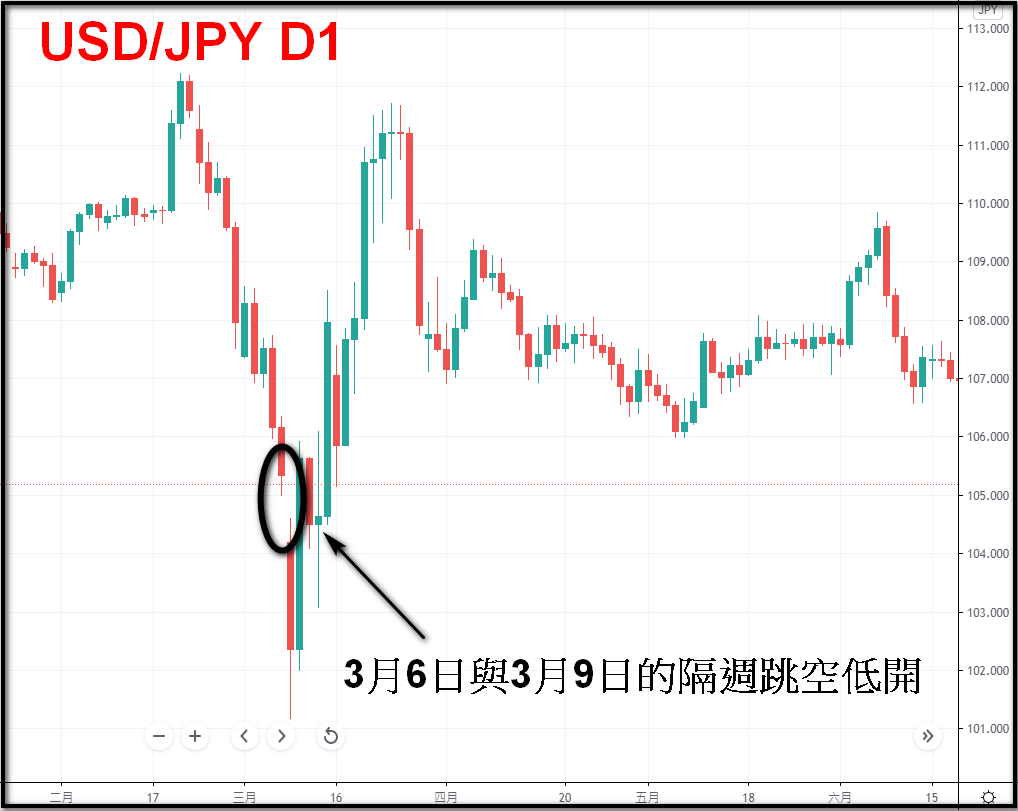

Gap market often occurs at the opening time of Monday, because some important economic data or heavy news may be released over the weekend, so the price can only reflect after the market is closed until the opening of Monday. At this time, there is a gap rise or fall. If the trader's order instruction price, such as the stop loss exit price, happens to be within the gap, the final transaction price will slip and deviate from the pre-set price, because there is no transaction in the gap.

Figure 2: USD/JPY gapped down on March 6 and March 9 .

In summary, the cause of slippage is that when the market changes and becomes sparse, resulting in greater volatility, traders' orders cannot find the best match in the market, and slippage occurs.

Slippage cannot be completely avoided, but the following points can effectively reduce its occurrence.

As the saying goes, "If you want to do your work well, you must first sharpen your tools." The solution is nothing more than upgrading your own computer configuration and network speed. If traders prepare external hardware in advance and reduce the possibility of network or hardware delays, they can reduce slippage problems caused by delays and unnecessary losses.

Successful traders must check the daily financial calendar regularly and avoid the times when certain high-risk events occur, such as the Federal Reserve's interest rate decision, US non-farm data , etc. These major events will inevitably bring huge fluctuations to the foreign exchange market. If you choose to wait and see at this time, it is also a trading strategy to avoid insufficient follow-up caused by trading problems and "slippage" losses.

Because the market is closed on Saturdays and Sundays, the market price cannot be reflected during the holiday due to unexpected emergencies. Therefore, it will explode when the market opens on Monday, causing drastic fluctuations in the market and greatly increasing the probability of "gap slippage". Therefore, it is recommended to keep no positions at the close of Friday, in order to avoid overnight interest charges and reduce the chance of additional losses due to gaps.

Some trading platforms provide transaction mode settings, which allow traders to set the maximum error range between the transaction price and the set price. If it is outside the error, the system will refuse to execute. If the trader does not accept any slippage error, he can choose the error of 0 on the platform , which means that the transaction must be completed at the current price of the order or at the price set in the order. However, this may make the overall transaction not smooth, requiring repeated execution of instructions, and miss some good trading opportunities.

In summary, for a foreign exchange trader, slippage is a normal trading phenomenon. Despite the uncertainty brought about by slippage, in fact, the profit and loss are still two different things ( there is a situation of "positive slippage" ) , which means that when the market price moves in a direction that is favorable to the trader, the final transaction price can be more ideal.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.